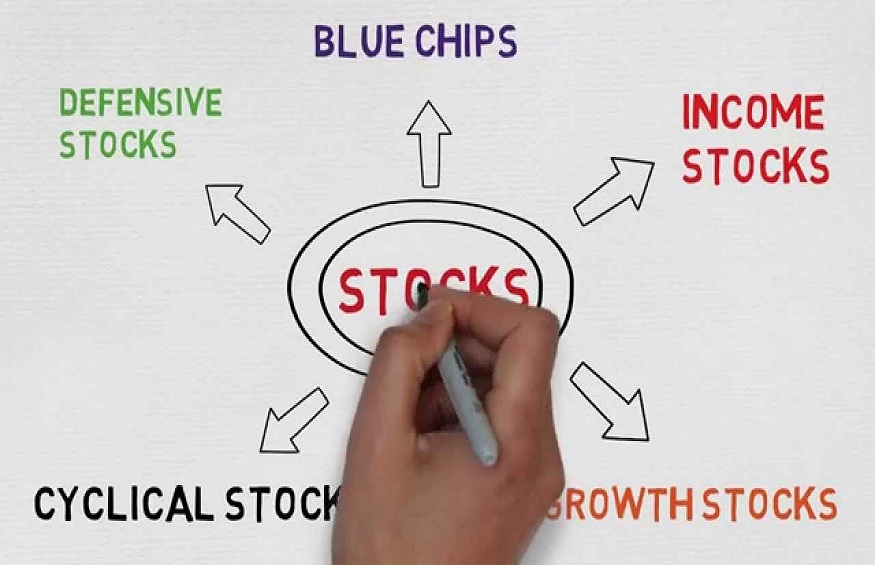

Stocks are one of the most popular investment vehicles, allowing investors to participate in the ownership and growth of companies. However, not all stocks are created equal, and investors should understand the different types of stocks available in the market.

Here are some of the most common types of stocks before you plan for buying stocks today:

Common stocks: These are the most common type of stocks and represent ownership in a company. Common stockholders have the right to vote on corporate decisions and receive dividends, which are a portion of the company’s profits paid out to shareholders. Common stocks offer the potential for high returns but also come with greater risk using the best trading app in India.

Preferred stocks: These are a type of stock that generally offers a fixed dividend payment and has a higher claim on a company’s assets than common stock. Preferred stockholders do not have voting rights, but they do have priority when it comes to receiving dividends in the event of a company’s bankruptcy. Preferred stocks generally offer lower returns than common stocks, but also come with lower risk while buying stocks today.

Blue-chip stocks: These are stocks of large, well-established companies with a long history of steady growth and stability. Blue-chip stocks are generally considered to be a safer investment and are often held by investors for the long term. These companies are typically leaders in their industry and are known for their strong financial performance while considering the best trading apps.

Growth stocks: These are stocks of companies that are expected to grow at a faster rate than the overall market. Growth stocks are generally newer companies with innovative products or services and have the potential for high returns, but also come with greater risk. Growth stocks typically reinvest their earnings into the company rather than paying out dividends when you check the idea of a demat account.

Value stocks: These are stocks of companies that are considered undervalued by the market. Value stocks are typically well-established companies that are temporarily out of favor with investors, often due to a temporary setback or an overall downturn in the industry. Value stocks are generally seen as a safer investment and offer the potential for steady returns over the long term when you are considering the best trading apps.

Penny stocks: These are stocks of small companies with low share prices and a high degree of risk. Penny stocks are often traded on over-the-counter markets and are subject to less regulation than larger companies. Penny stocks are generally seen as speculative investments and are often targeted by scammers.

Dividend stocks: These are stocks of companies that pay out regular dividends to shareholders. Dividend stocks are often seen as a safer investment, as they provide a regular stream of income to investors. Dividend stocks are typically well-established companies with a long history of paying dividends while checking the buying stocks today.

Cyclical stocks: These are stocks of companies that are highly sensitive to economic cycles. Cyclical stocks are often found in industries such as construction, automotive, and technology. These companies generally perform well during periods of economic expansion but may struggle during economic downturns when you consider the best trading apps.