Margin trading is a popular strategy in the share market, allowing traders to borrow money to buy more shares than they can afford. While it can lead to higher profits, it also comes with significant risks. Many beginners make mistakes that can cost them money and lead to stress. Understanding these common mistakes is essential for anyone looking to trade using a share market trading app or a mobile trading app. This blog will explore the common pitfalls in margin trading and provide tips to avoid them, helping you navigate the world of trading more confidently.

1. Lack of Knowledge

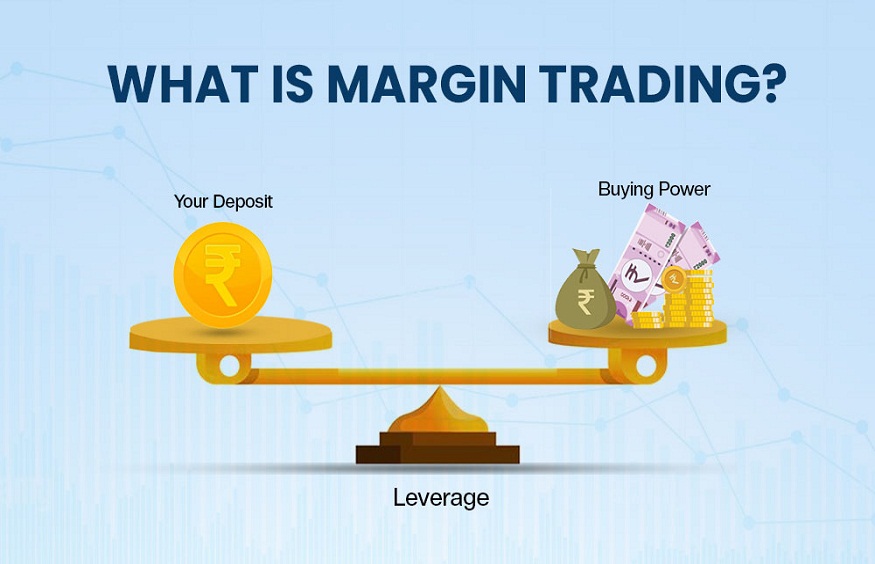

One of the biggest mistakes beginners make is starting margin trading without understanding how it works. Margin trading involves using borrowed funds, meaning you can amplify your gains but also increase your losses. Many new traders jump in without fully grasping the concepts of margin calls, leverage, and the risks involved. It is crucial to educate yourself about these terms and their implications before you open demat account and engage in margin trading.

2. Over-Leveraging

Leverage allows traders to control a larger position with a smaller amount of their own money. While this can lead to higher returns, over-leveraging is a common mistake that can lead to significant losses. If you use too much leverage, even a small market movement can result in large losses that exceed your initial investment. It is advisable to use leverage cautiously and only take on positions you can afford to lose.

3. Ignoring Risk Management

Another common mistake is neglecting risk management strategies. Successful traders use stop-loss orders to limit potential losses on trades. This tool automatically sells a stock if it drops to a certain price, helping to protect your investment. Many beginners do not set stop-loss orders, thinking they can manage their trades without them. Implementing risk management techniques is vital to safeguarding your capital when using a share market trading app.

4. Emotional Trading

Emotions can heavily influence trading decisions, leading to mistakes. Fear and greed often drive traders to make impulsive choices. For instance, a trader may panic and sell shares during a market dip, only to miss out on a recovery later. Conversely, greed may prompt them to hold onto a winning position for too long, risking their profits. To avoid emotional trading, it is essential to develop a solid trading plan and stick to it, regardless of market fluctuations.

5. Neglecting Market Research

Successful margin trading requires thorough market research. Some beginners make the mistake of relying solely on tips from friends or social media, which can lead to poor investment choices. Instead, take the time to research the companies you plan to invest in, analyse market trends, and understand the factors that influence stock prices. A well-informed decision will increase your chances of success in the share market.

6. Failure to Diversify

Another mistake beginners often make is putting all their funds into one stock or sector. This lack of diversification can lead to increased risk, as poor performance in a single stock can significantly affect your overall portfolio. Diversification helps spread risk across different assets, reducing the impact of a single loss. When using a mobile trading app, consider spreading your investments across various sectors and asset classes.

7. Not Monitoring Your Trades

Once a trade is executed, some beginners forget about it, assuming it will go according to their plan. This lack of monitoring can lead to missed opportunities to exit a losing position or take profits on a winning trade. Regularly reviewing your trades is crucial for adjusting your strategy as needed. Many share market trading apps provide tools and alerts to help you stay updated on your investments.

8. Ignoring Fees and Costs

Trading on margin often comes with additional fees, such as interest on borrowed funds and commissions on trades. Many beginners fail to account for these costs, which can eat into profits. Before engaging in margin trading, it is essential to understand the fees associated with your trades. This knowledge will help you calculate your potential profits accurately and make informed decisions.

Conclusion

Margin trading can be a valuable tool for experienced traders, but it comes with risks that beginners must be aware of. By avoiding common mistakes such as lack of knowledge, over-leveraging, and neglecting risk management, you can improve your trading outcomes. Educate yourself, create a solid plan, and diversify your investments to navigate the share market more effectively. With careful planning and awareness of these pitfalls, you can